Reading List #1

Hello, World!

Old habits die hard. And I like to remember that I started off as a developer many years ago. Hence the most cliched first words. But who cares.

Welcome to my newsletter.

I have literally no idea what I’m thinking of doing here. I went from decision to this post in about 5 minutes. But the seed for it was sowed some time back, when in a 1:1 discussion one of my teammate asked me if I could give him access to my list of great reads. And that got me thinking.

But I’m not planning on setting a fixed model for this newsletter. I’ll post reading lists, one-off articles, opinion pieces or whatever fancies me at that time. I don’t plan on making this an elaborate side-project with a vanity goal of getting a high subscriber count.

What I can guarantee is that the frequency of posts will not exceed once a week. And I’ll keep the content interesting enough to not make it feel like spam.

With this aside, let’s get into the Reading List #1.

It’s Time to Build — Elsewhere

I believe that reading about how people’s careers shaped up over the years is extremely insightful. Came across this post by Ian McAllister on his 12 years with Amazon. He has worked on Amazon Smile, Day, Alexa, Gifting, Social Apps etc. The post also gives a glimpse of the Amazon culture, particularly parts he loved.

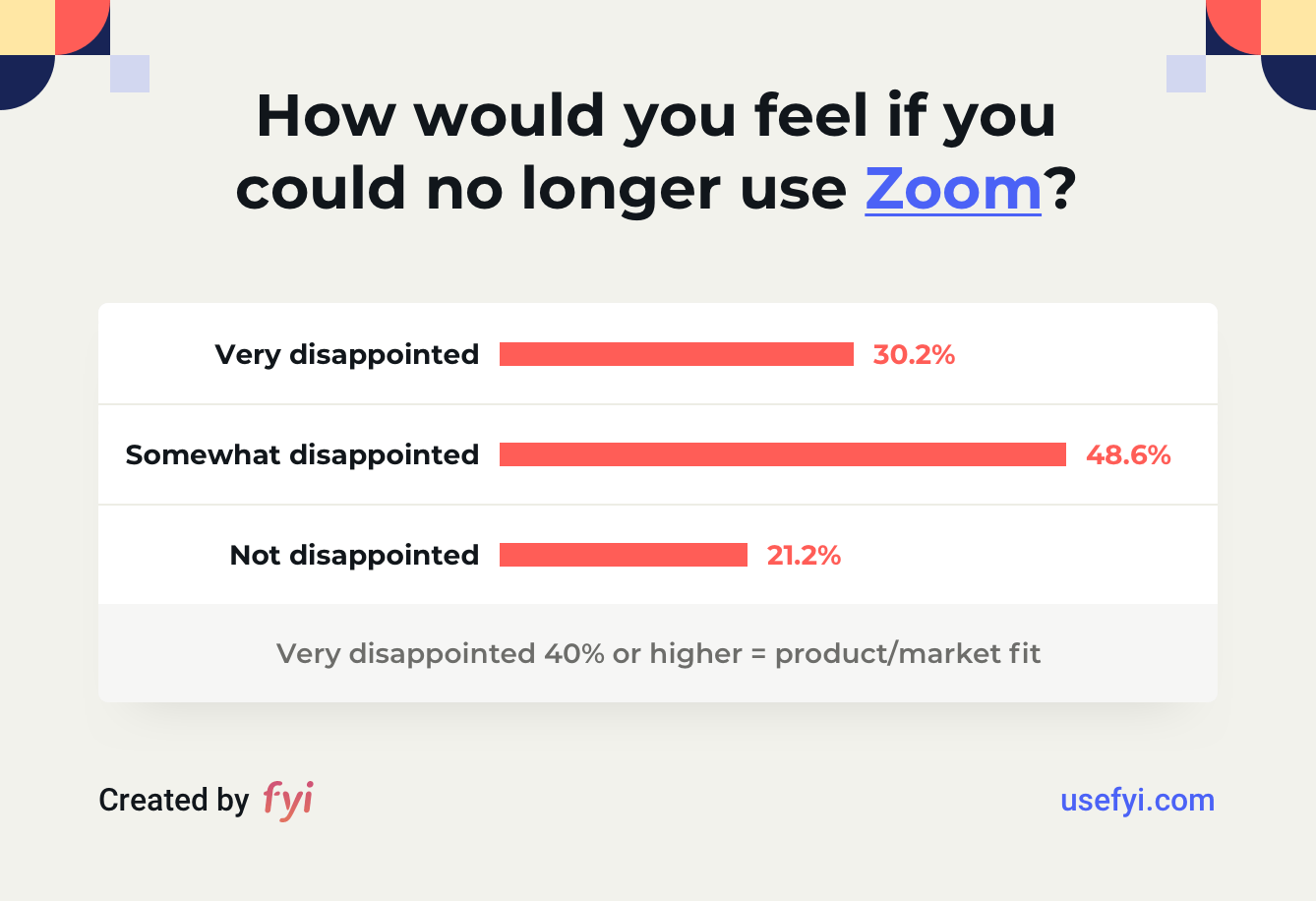

Why Zoom doesn’t have product/market fit

Hiten Shah and Fyi team surveyed 1000+ people on Zoom, using the NPS + the Superhuman method of measuring product market fit. The results are pretty interesting. The post claims that Zoom does not have product/market fit.

Personally, I don’t fully buy into this report. There are many reasons why it may not be giving the full picture:

Product/Market fit should be measured for the target segment

When an app gets popular, it attracts people outside of target segment too, and can easily lead to a lower NPS scores when averages are considered

I personally don’t think there’s any framework which is the gospel, when it comes to concepts like Product/Market fit. Heck, what the term itself means isn’t clear to people. But almost everyone gets it when there is product market fit.

That said, I’m still linking to this article because I think it’s an interesting viewpoint. And I don’t need to agree with a viewpoint for me to appreciate it.

The Hierarchy of Marketplaces

This is a three part series by Sarah Tavel, General Partner at Benchmark. Link to each part below:

I’m a sucker for well structured thesis on anything. And this was a great breakdown of what it takes to create a great marketplace product.

Biohacking Lite

Andrej Karpathy is the senior director of artificial intelligence and Autopilot Vision at Tesla. And in this article he has geeked out on the science behind weight-loss.

I first got interested in the science of how our body processes food and stores energy when I tried the keto diet about two years ago. It’s super interesting. And Andrej has distilled it down to an article that explains a lot of it pretty well.

This is definitely worth a read if your preference is for science over reader’s digest kind of articles on weight loss.

MorningBrew’s Twitter Strategy

Apart from structured thesis docs, I’m also a big sucker for display of creativity. And this thread had a bucketful of it.

Startup Stock Options – Why A Good Deal Has Gone Bad

Steve Blank has written a long post on why the model of Startup Stock Options is now outdated. I’m adding his core points below:

First, as the company raises more money, the value of your initial stock option grant gets diluted by the new money in. (VC’s typically have pro-rata rights to keep their percentage of ownership intact, but employees don’t.) So while the VCs gain the upside from keeping a startup private, employees get the downside.

Second, when IPO’s no longer happen within the near-time horizon of an employee’s tenure, the original rationale of stock options has disappeared. Now there’s little financial reason to stay longer than the initial grant vesting.

Third, as the fair market value of the stock rises (to what the growth investors are paying), the high exercise price isn’t attractive for hiring new employees, especially if they are concerned about having to leave and pay the high exercise price in order to keep the shares.

And finally, in many high-valued startups, today’s founders get to sell parts of their vested shares at each round of funding. (At times this opportunity is offered to all employees in a “secondary” offering.)A “secondary” usually happens when the startup has achieved significant revenue or traction and is seen as a “leader” in their market space, on the way to an IPO or a major sale

As with all things, this does not hold for every scenario around stock options. But it does have a lot of fair points. For points (2), (3) and (4), one of the viable solutions is to carry out stock buybacks for employees on a regular cadence (preferably once every 1-2 years). This allows employees to cash out a part of their stock options without having to deal with high exercise price, paying taxes out of pocket etc.

Why VC Investors Pass on Startups

An interesting Twitter thread. Worth going through to understand the various ways VCs decide to pass on a startup.

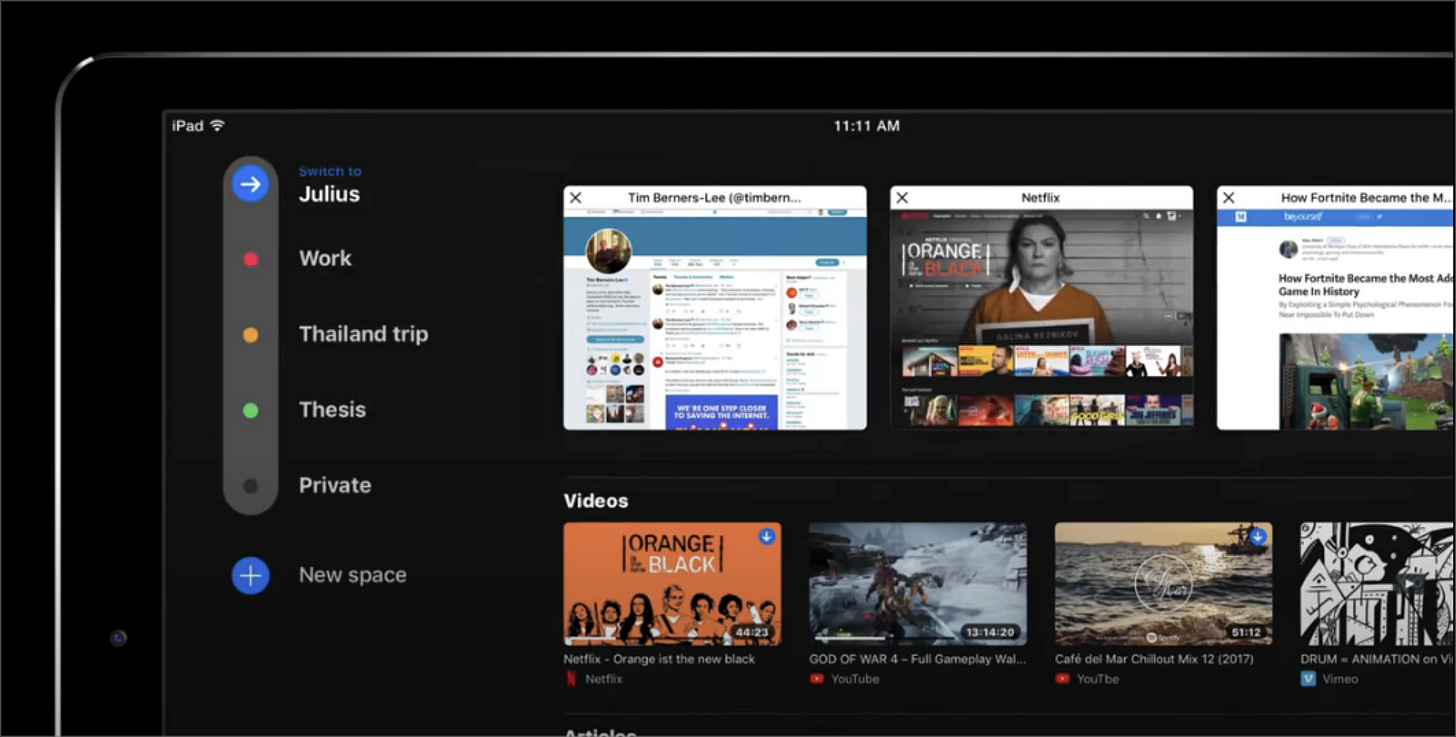

Refresh - A Browser Concept

Had a few interesting ideas around organising spaces in a browser. I believe the browser market is up for disruption anyway. Chrome is bloated.

Those are some great recommendations SM (loved hereirchy of marketplaces). For PMF, will highly recommend this article by Brian Balfour. https://brianbalfour.com/essays/product-market-fit

Thanks for sharing this.